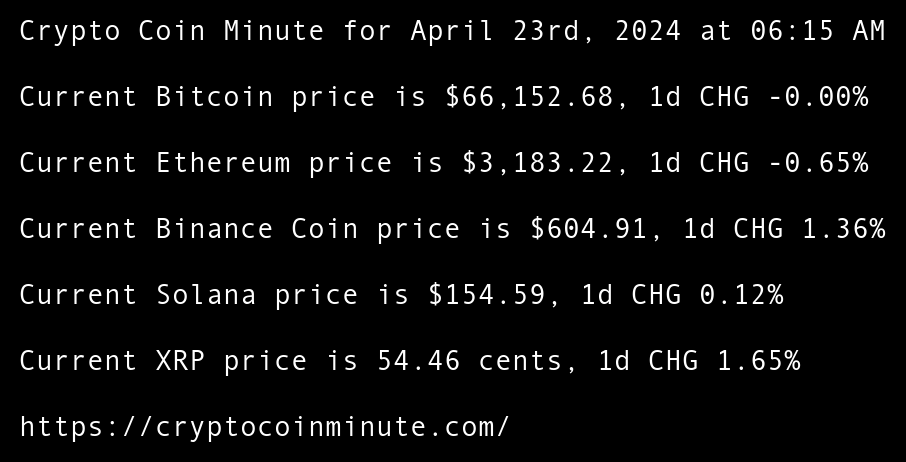

Crypto Coin Minute for April 23rd, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $66,152.68, 1d CHG -0.00% Current Ethereum price is $3,183.22, 1d CHG -0.65% Current Binance Coin price is $604.91, 1d CHG 1.36% Current Solana price is $154.59, 1d CHG 0.12% Current XRP price is 54.46 cents, 1d CHG 1.65% BRICS Bloc Mulls

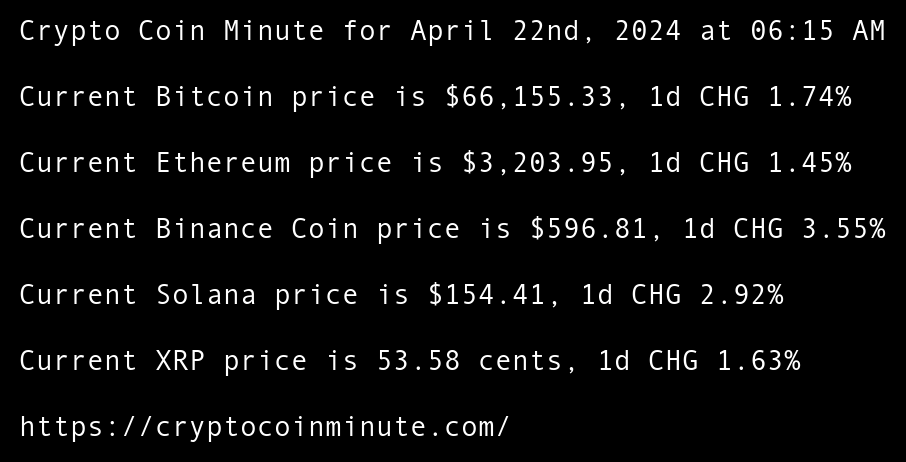

Crypto Coin Minute for April 22nd, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $66,155.33, 1d CHG 1.74% Current Ethereum price is $3,203.95, 1d CHG 1.45% Current Binance Coin price is $596.81, 1d CHG 3.55% Current Solana price is $154.41, 1d CHG 2.92% Current XRP price is 53.58 cents, 1d CHG 1.63% Tether Expands to

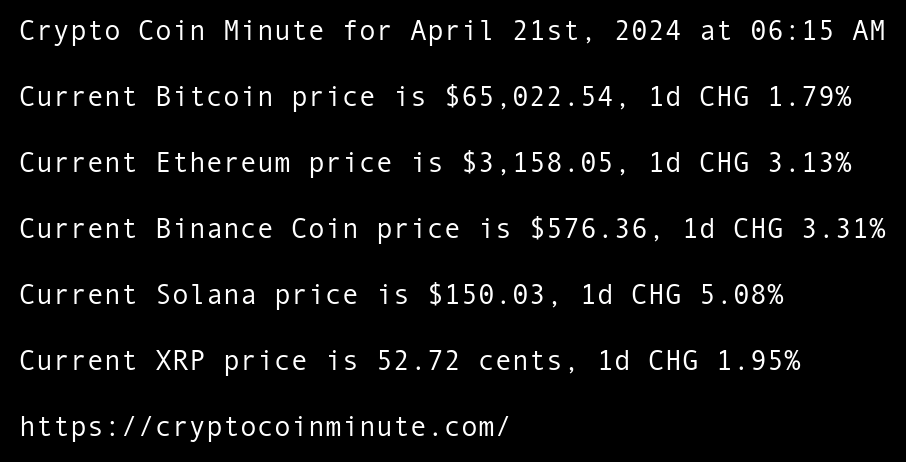

Crypto Coin Minute for April 21st, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $65,022.54, 1d CHG 1.79% Current Ethereum price is $3,158.05, 1d CHG 3.13% Current Binance Coin price is $576.36, 1d CHG 3.31% Current Solana price is $150.03, 1d CHG 5.08% Current XRP price is 52.72 cents, 1d CHG 1.95% Deutsche Bank Expects

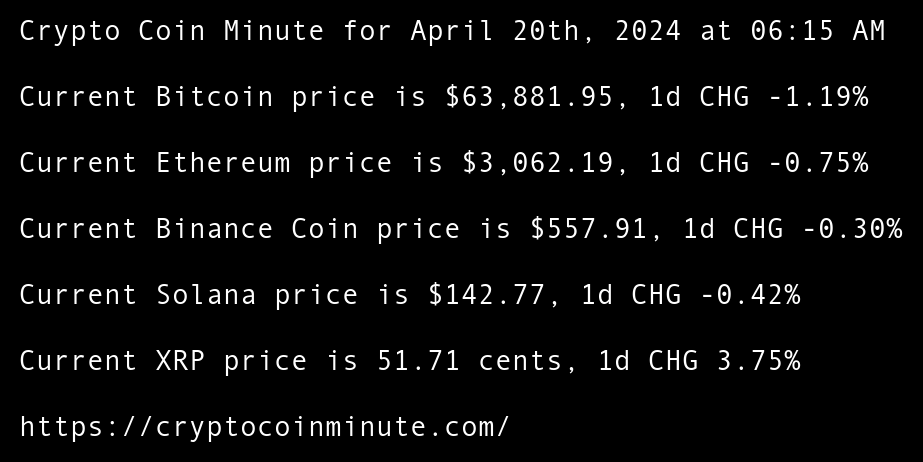

Crypto Coin Minute for April 20th, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $63,881.95, 1d CHG -1.19% Current Ethereum price is $3,062.19, 1d CHG -0.75% Current Binance Coin price is $557.91, 1d CHG -0.30% Current Solana price is $142.77, 1d CHG -0.42% Current XRP price is 51.71 cents, 1d CHG 3.75% Bitcoin spot ETFs

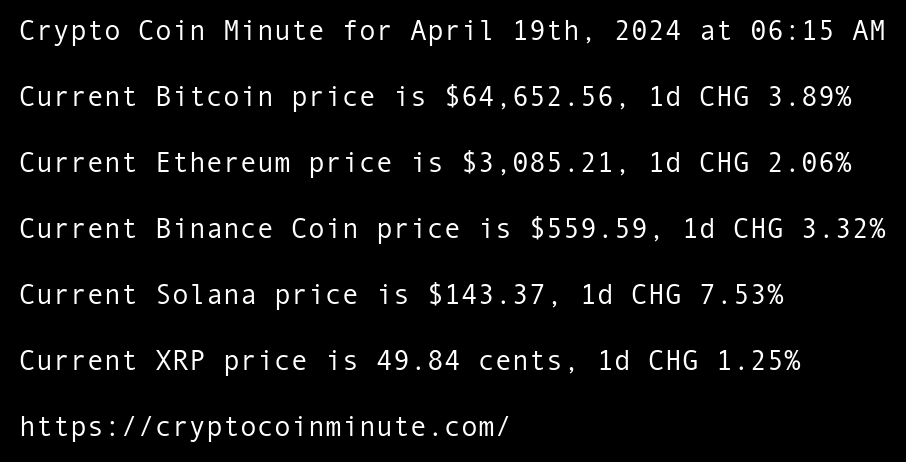

Crypto Coin Minute for April 19th, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $64,652.56, 1d CHG 3.89% Current Ethereum price is $3,085.21, 1d CHG 2.06% Current Binance Coin price is $559.59, 1d CHG 3.32% Current Solana price is $143.37, 1d CHG 7.53% Current XRP price is 49.84 cents, 1d CHG 1.25% IMF says Bitcoin

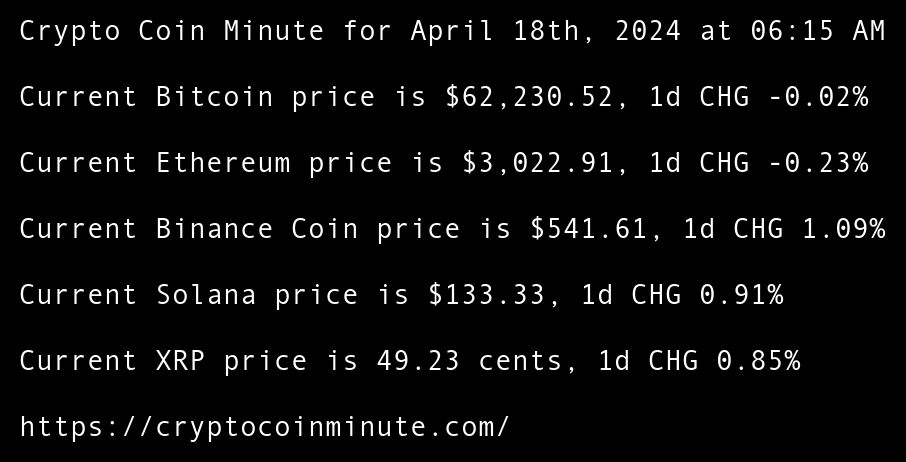

Crypto Coin Minute for April 18th, 2024 at 06:15 AM Pacific Time.

Current Bitcoin price is $62,230.52, 1d CHG -0.02% Current Ethereum price is $3,022.91, 1d CHG -0.23% Current Binance Coin price is $541.61, 1d CHG 1.09% Current Solana price is $133.33, 1d CHG 0.91% Current XRP price is 49.23 cents, 1d CHG 0.85% Worldcoin unveils World